Mr. Marvy Finger, an 86-year-old Houston based real estate investor, was featured this month in Forbes magazine[1] in a fascinating article about the future of rental properties.

Turns out that Marvy Finger recently sold 2 billion dollars worth of rental properties to real estate investor Greystar. Yes, you read it right: 2 billion dollars (worth exactly two thousand million dollars, and that's just half of what Marvy Finger owned before the trade). The article's central theme is that Marvy Finger thinks rents must come down, in short to midterm, from what he thinks are unsustainable levels. In contrast, Gresytar believes that rents will keep increasing, and it's a good time to invest in rental properties.

When someone as smart and business savvy as Marvy Finger or Greystar talk or give an interview, we better stop and reflect on their words. While reading the Forbes interview, our curiosity was piqued whether rents will go up or down, which we will discuss next. Still, also, we have been let in by Mr. Finger himself on how he got to have 4 billion worth of properties. Our take on that, later down this blog.

The future level of rents

Apart from featuring a real estate guru like Marvy Finger, this Forbes article is interesting because it clarifies that rent levels do make all the difference between having a successful rental property investment and a flop. Why a flop? Because if you are highly leveraged in your assets (that is, you have a lot of debt to pay because you financed your acquisition), rent levels will be a crucial factor in meeting your financial obligations.

As for most real estate investors, falling rent levels or increasing rental property supply can make your rental property be less profitable. Rent levels are not only determined by regional and national economic conditions but also by local conditions such as a location's desirability, tenant experience (building qualities, included amenities, and others), as well as local housing trends (for example, vacancy rates, new migration to the area, etc.).

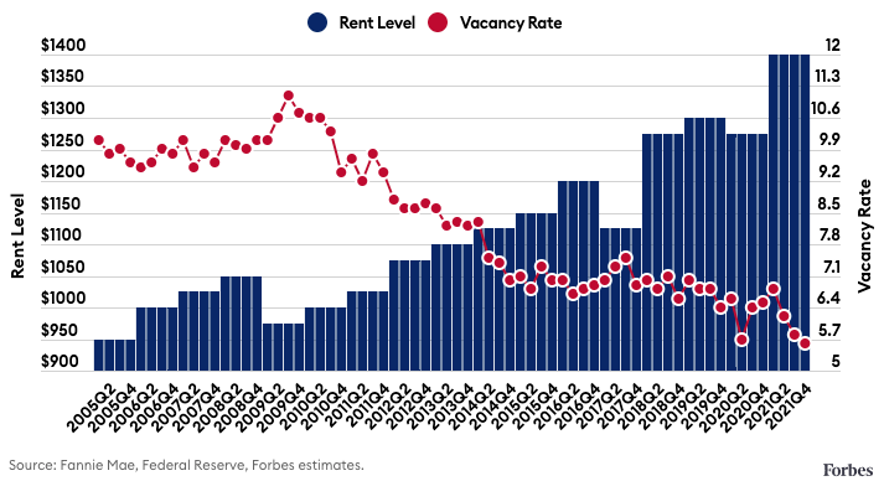

There's a nice graph in the Forbes article which shows that in the past 17 years, two things have happened:

- Vacancy rates have gone down from a stable 10% between 2005 and 2010 to what is now in 2022. The vacancy rate is below 6.0% (and getting closer to 5%, give or take a few decimal points), "with outright shortages in the hottest markets," says the Forbes article.

- We observed rent levels that grew about 10% in 12 years and grew almost 25% in the past five years.

Greystar is betting on these trends continuing in the future (tighter supply and higher rents). At the same time, Mr. Marvy Finger thinks rents will come down and, due to many investors getting in on the action, rent levels will come down from where they are now. Vacancy rates will most likely go back up to previous levels.

We sure do not know who is right! But one thing we do know: when you develop your business plan, you should include three scenarios (at least):

(1) rent levels staying where they are right now (that is, do not bet on being profitable because your investment will have more rental income),

(2) rent levels increasing, albeit not 25% in 5 years (so, let's say more like 15% in 10 years), and

(3) rents coming down in the next five years.

Based on these numbers, you can be pretty sure that you'll meet your obligations even in a downturn and still make some money on your investment (either by property appreciation or downright cash flow). Mr. Finger decided that his properties would not be as profitable as selling them for what Greystar offered, so he sold them.

Other insights from the Marvy Finger interview

Marvy Finger has been investing in real estate for almost 60 years. He surely does know one thing or two about the industry. It became evident while reading his story that you must be prepared to weather the inevitable economic crisis. Marvy Finger weathered: (a) the 1973 oil crisis, (b) the 1982 oil bust, and (c) the 2008 Lehman Brothers MBS meltdown, to name a few. So, a lesson learned for real estate investors: downturn scenarios do happen.

For that, you must study the market and do your research; here are five valuable tips from our very own Jim Emerson:

- Study, study, study the market,

- Keep the following maxim in mind: location, location, location,

- Analyze the pros and cons of every deal you are eyeing,

- Do not fall in love with an idea you have in mind. Instead, make a decision based on the cold, hard math. If it is not profitable according to your rules, you should not get into it,

- Do not overextend yourself or become too "leveraged."

As Marvy Finger has been quoted: "The fundamentals have to make sense." When they do, go ahead. Perhaps one day, you might also become a billionaire!

Summary

If you have decided to purchase a rental property, prepare your rent scenarios. If they still make sense, choose to consult with AMI Lenders, as we are one of Houston's fastest closers and could become your financial ally. We fund our own loans and can move as fast as the law allows. Borrowers in Houston will also have a hard time finding lower rates for hard money or private loans than we offer. We want our customers to succeed and take advantage of the financial opportunities provided by real estate investments. Visit our website today and fill out an application for a loan backed by a rental property.

[1] https://www.forbes.com/sites/christopherhelman/2022/03/08/will-your-rent-keep-skyrocketing-not-if-this-billionaire-is-right/?sh=4affce8c2d1e