In a previous entry Is it still a good time to buy a house in Houston? A Hard Money Lenders' Perspective investing in real estate in Houston, we stated that the US economy is facing complicated macroeconomic forces. This statement has been proven true once again in the past few days.

On September 21, 2022, the Federal Reserve raised its benchmark interest rate by 0.75 percentage points for the third time in a row. These increases send a clear signal to the market of its intention to keep monetary policy tight as it tries to hit the brakes on the overheating US economy: our central bank has been looking to bring down inflation, which has been running near its highest levels since the early 1980s.

This recent decision will increase the Fed’s benchmark federal-funds rate to a range between 3.0% and 3.25%. New projections from central bank policymakers showed the benchmark rate rising to 4.4 percent by the end of 2022 before peaking at 4.6 percent next year.

What does this mean to a potential home buyer or a Private Lender?

These increases in the benchmark interest rate will lead to the highest 30-yr fixed mortgage interest rates we’ve seen in many years. Home mortgage rates have seen increases and are due to continue to rise during the last quarter of 2022 and the first semester of 2023.

It is within this context that we intend to answer for our readers the highly relevant question: Is it still, during the fourth quarter of 2022, a good time to buy a house in the Houston area?

The Spoiler: we believe it is still an excellent time to buy in Houston Texas

Yes, at AMI Lenders, we believe that between the period of October 2022 and March 2023, it will still be a good decision (and time) to buy a house in the Houston area if the following three criteria apply to you as a purchaser:

- You have the required income, down payment funds, and credit scores to qualify for a home loan.

- You plan on settling down for at least 5 to 7 years.

- You don't currently live in rent-controlled lodgings where you pay rent at levels far below market rates.

The Current Context for an Investment Opportunity

Current interest rates are not tragic. Even with the Fed’s September 21 rate increase, and the forecast increases for the next six months, interest rates today, at 3.25%, are significantly at lower levels than the maximum observed for the past three decades (6.54%, June 2000).

Still attractive mortgage interest rates for real estate investors.

Yes, 30-year fixed mortgage rates have pushed up to new 14-year highs; at around 6.36% on average, these are the highest rates since 2008. Mind you; mortgage rates will likely rise in the following semester (because of further Fed increases to the benchmark interest rate). Still, they will most likely hold steady for the years 2024 and 2025. And although not as low as rates during the 2010-2019 decade, current rates are similar to what we experienced on average during the 2000-2009 decade and better than rates experienced in the 1990-1999 decade.

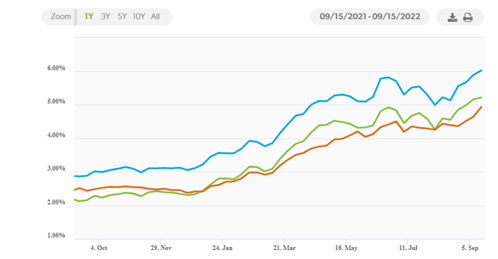

The days of sub-3 percent mortgage interest on the 30-year fixed are behind us, so people tend to think current rate levels "are expensive." But please do not mislead yourself by comparing mortgage interest rates that include only the past few years, for example, the following Figure 1 (all data from Freddie Mac's website), in which rates are shown to have doubled recently.

Figure 1. 30-yr fixed mortgage rates for the past 12 months

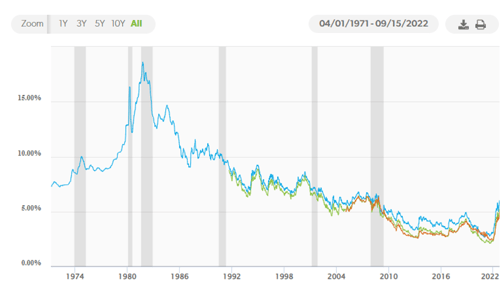

Give yourself a solid point of comparison and include in your evaluation data from several decades.

For example, the average mortgage rate between 2000 and 2009 was 6.25% (based on weekly average rates published by Freddie Mac), with 36 out of 40 quarters having yearly rates above 6%; furthermore, rates today are reasonable if you compare them to the average rate between 1990 and 1999 which was 8.12%. You should ask yourself if these current rates in the 6.5% to 7% range make sense to you. Historically, today’s levels can still be considered reasonable and an excellent rate to pay for a long-term mortgage.

Figure 2. 30-yr fixed mortgage rates for the past 50 years

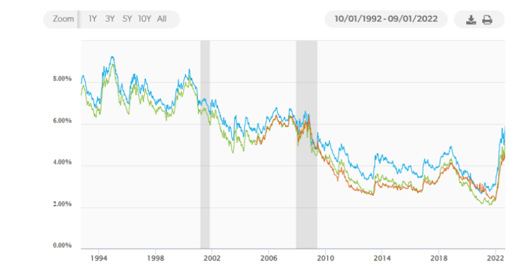

Even when comparing the past two decades, today’s 30-yr fixed mortgage interest rates are reasonable. Figure 3. 30-yr fixed mortgage rate for the past 20 years

Figure 3. 30-yr fixed mortgage rate for the past 20 years

[For 30-yr mortgage rate and weekly historical data, please refer to the Freddie Mac website at https://www.freddiemac.com/pmms. If you’d like to see the historical chart on 30-year mortgage levels, you can also refer to: https://fred.stlouisfed.org/series/MORTGAGE30US]

Housing prices continue to grow, and property supply is still tight.

As mentioned in our previous blog, while home prices appear expensive, they are forecasted by most analysts to climb somewhat higher (Link to our previous blog on homeownership here). And although the increase in mortgage rates will continue to dampen demand and put downward pressure on home prices, inventory remains inadequate. This indicates that while home price declines will likely appear in some areas, these declines should not be significant in the Houston area if any declines are experienced at all. Furthermore, quoting an article in the Texas Tribune:

“Barring a recession, real estate experts don't expect home prices to come down anytime soon because Texas is still gaining thousands of residents and its job market is still growing — but they expect prices to grow more slowly than they did over the past two years.”[1]

Having the financial capacity to own might seem like a tall mountain to climb.

However, surprisingly those with the financial capacity are still apparently large in numbers. Not being priced out of a lovely home and a good deal still requires patience, persistence, and luck. And although it might sound corny, Houston is still a very vibrant economy. It will remain so for decades, no matter what the future can bring.

Once again, the Texas Tribune reporting states, “Typical entry-level homes for first-time buyers — priced at around $200,000 — are now much more difficult to find. The share of new homes in that price range grows smaller each year as the home cost increases.” This trend will not disappear any time soon, so it adds to the “Pros” of purchasing a home in the next six months: lock in an affordable home while supplies last.

Mortgage payments tend to stay fixed while rent levels increase. Most homeowners who bought in 2008 (at rates like today’s rates) have aggregated mortgage loan, maintenance, and property-tax payments that are lower today (14 years later) than rent on a smaller property. The only exception we can consider is if you live in a rent-controlled apartment. This last happens because landlords will adjust rent levels based on inflation. In contrast, fixed mortgage payments stay fixed over the mortgage's lifetime.

Summary

If you are considering the purchase of a home or investment property in 2022 or early 2023, rely on the opinion of Houston’s Premier Money Lender. We have seen and experienced the Texas real estate market in the last four decades, personally and professionally: and we can tell you that now is still an excellent time to buy a home in Houston.

AMI Lenders Inc. is "open for business," We are ready to help you get the loan you need, when you need it, with exemplary service and at our best rate.

Consult with one of AMI Lenders' expert loan advisors. We are one of Houston's fastest closers and could become one of your best financial allies. We fund our loans and can move as fast as the law allows. Borrowers in Houston will also have a hard time finding lower rates for hard money or private loans than we offer.

We want our customers to succeed and take advantage of the financial opportunities offered by home ownership. Visit our website today and fill out an application for a loan backed by a mortgage.

[1] https://www.texastribune.org/2022/09/01/texas-housing-market-cooling/