Use our Mortgage Loan Calculator to calculate your Loan payments.

Result:

Home Loan Calculator

AMI Lenders is a source of funding for borrowers with bad credit or who, for whatever reason, are unable to use traditional loan sources to get the loan they need.

AMI Lenders is not a bank. We are a private lender with the flexibility to respond quickly to just about any loan request.

Use our Mortgage Loan Calculator to calculate your loan payments. Then apply for your loan online!

Maximum Terms on Commercial Loans

- 3-5 years on a 20-year amortization on all properties Other than unimproved properties

- 3 years on a 10-year amortization on unimproved properties.

Prohibited Loans

- Outside of the Greater Houston area

- Unsecured loans

- Second lien (or any inferior liens)

- Home equity loans

- Night Clubs &/or Bars

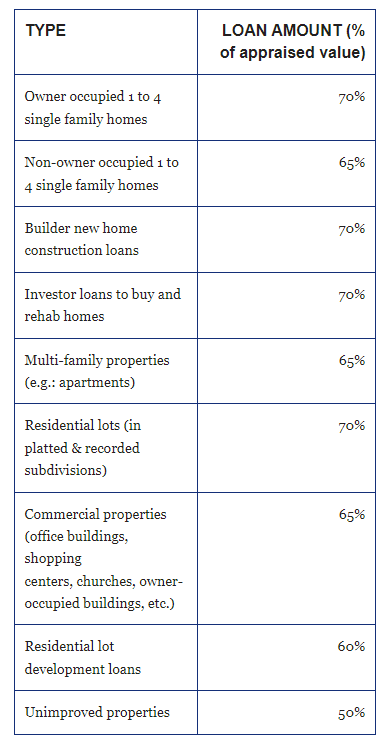

Amounts & Types of Loans

Additional documentation for construction and rehab loans

- Complete set of plans

- Line item budget including a 10% contingency line (download sample budget)

- Specs (flooring materials, finishes, countertops materials, lighting & plumbing fixtures, etc.) (download sample specs)

Interest Rates & Fees

Depending on credit, equity, and the borrower’s ability to service the debt. (An origination fee or points may be required depending on the type of loan and/or the terms). The borrower must pay normal costs as required for any real estate loan: e.g.: appraisal fee, survey, title policy, loan document preparation, and other normal closing costs.

Loan Qualifications

AMI lends strictly on the value of the property and the borrower’s ability to service the debt. Bad credit, bankruptcy, etc. is not a concern. Use our home mortgage calculator to find our your payments.

Documentation Required

- An appraisal (ordered by AMI)

- Phase One Environmental Study (on commercial properties)

- A blue-line survey

- Loan application (Fannie Mae Form 1003)

- Borrower’s most recent two years' Federal Income Tax Returns

- Monthly Cash Flow Statement (download)

- Proof of identification (driver’s license or other acceptable personal identification)

- Other documentation may be required depending on the type of loan requested.